How Invoice Template Is An Ideal Step For Small Businesses?

An invoice template is an ideal step for small businesses as it facilitates easy and accurate tracking of expenses, eliminates the need to account for multiple currencies, provides visibility into client payments and keeps track of sales history.

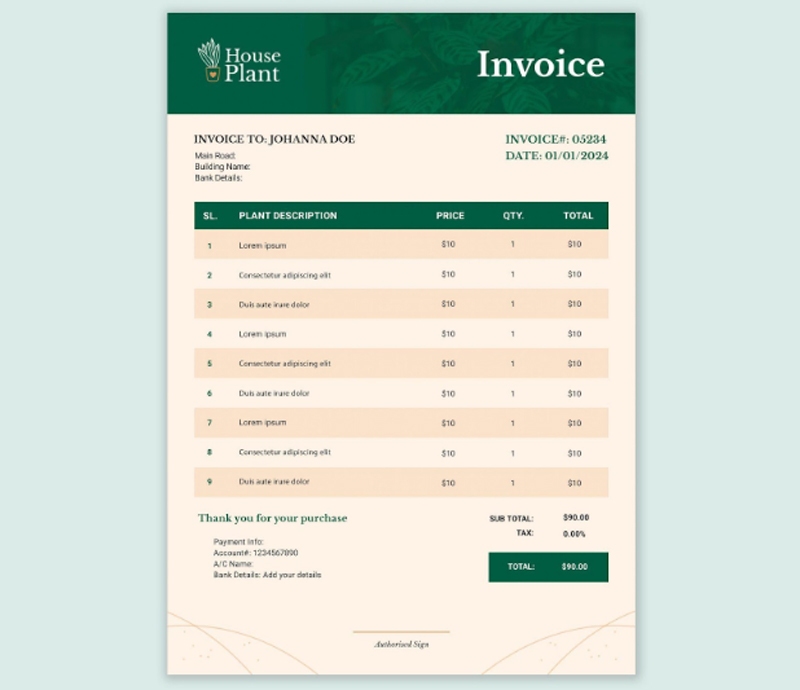

An invoice template can be customized according to the requirements of the small business and its accounting software. Additionally, various templates are available in different formats, such as PDF, Excel and Word, so they can be easily shared with clients or employees. Furthermore, it is important to note what’s receipt vs invoice.

While both serve as proof of purchase, an invoice is sent before payment is received and outlines what the buyer owes, whereas a receipt is issued after payment is received and serves as proof of payment. Using an invoice template ensures that small businesses are providing accurate invoices to their clients, which can help prevent confusion and delays in payment. The advantages of using an invoice template include the following:

- Eliminates error-prone tracking of expenses

- Gives businesses visibility into their spending trends

- Helps keep track of sales history

- It can be customized to suit the needs of the business

- Is easily shared with clients or employees

Also Read: Youtube Marketing Tips for Small Business

6 Advantages Of Using An Invoice Template For Small Businesses

As a small business owner, you may juggle multiple tasks, including creating and sending client invoices. However, manually creating invoices can be time-consuming and prone to errors. Using an invoice template can be an ideal step for your small business. Here are six advantages of using an invoice template:

1. Helps keep track of expenses:

Businesses can easily track their expenses thanks to the easy and accurate tracking provided by an invoice template. This eliminates the need to account for multiple currencies and clarifies how much money has been spent on various projects or activities.

2. Increased transparency:

An invoice template makes it easy for businesses to share their spending information with clients or employees, ensuring everyone knows what’s been done and where the money went. This increased level of transparency can be invaluable in driving positive feedback and cementing relationships with key stakeholders.

3. Improved efficiency:

By using an invoice template, businesses can save time and effort tracking expenses and monitoring spending trends. This streamlined process makes it simpler to identify areas of spending that need improvement or adjustment, ensuring that financial pressures are dealt with efficiently and effectively.

4. Increased transparency leads to improved customer relations:

When businesses are transparent about their spending habits, customers are more likely to trust them with future transactions – this fosters better relationships between business partners and creates a mutual understanding that benefits both sides.

5. Helps keep track of sales progress:

Keeping track of sales progress can be difficult if sales invoices need to be formatted in a specific way. Businesses can use an invoice template to ensure that all orders and transactions are accurately logged and easily accessible for future reference.

6. Helps to maintain compliance with financial regulations:

Many countries have stringent financial rules that dictate how businesses conduct their operations. Using an invoice template makes it easier for companies to adhere to these guidelines, ensuring that they abide by the law and stay within prescribed budgets.

Also Read: How To Make Your Business More Appealing To Suppliers

Why are Invoice Templates Important for Small Businesses?

There are many challenges that small businesses face when it comes to invoicing – these include the need to keep track of expenses and spending trends, as well as complying with financial regulations.

Invoicing can be challenging for small businesses, mainly if they are new to the process. By using an invoice template, companies can streamline this process, improve efficiency and transparency, and enhance customer relations.

Also Read: It’s High Time You Employed Tech to Make Your Business Smart

How Could A Business Benefit From Using An Invoice Template?

1. Transparency:

By producing standardized invoices, businesses can ensure that all customers receive clear and concise information about the services provided. This makes it easier for customers to understand costs and budgets properly for future projects. Additionally, small businesses can avoid incurring unexpected charges by ensuring that expenses are tracked accurately.

2. Efficiency:

By centralizing the process and automating specific steps, companies can save time and resources when invoicing. This can help to boost productivity and improve overall efficiency. This could lead to more significant savings for businesses in the long run.

3. Customer Relations:

Companies can build trust with their customers by issuing accurate and concise invoices. This helps cultivate a positive relationship, leading to increased customer loyalty and repeat business.

Also Read: Best 5 Advantages of Internal Auditing to Help Your Business

How to Choose the Right Invoice Template for Your Small Business?

When choosing a template, businesses should consider the specific needs of their business. Below are some key factors to consider:

1. Budget:

By evaluating your budget well before creating an invoice, you can ensure that all costs are accounted for and included in the template. This will help to avoid any surprises or discrepancies down the line.

2. Timescale:

The time frame for issuing invoices is also vital to take into account. Templates that are flexible enough to cater to short-term and long-term requirements can be ideal.

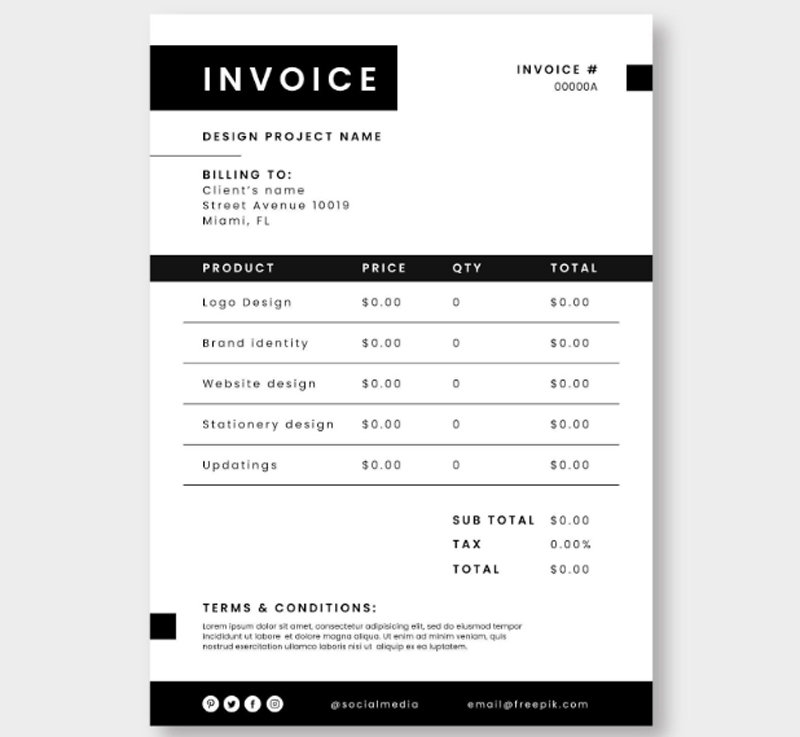

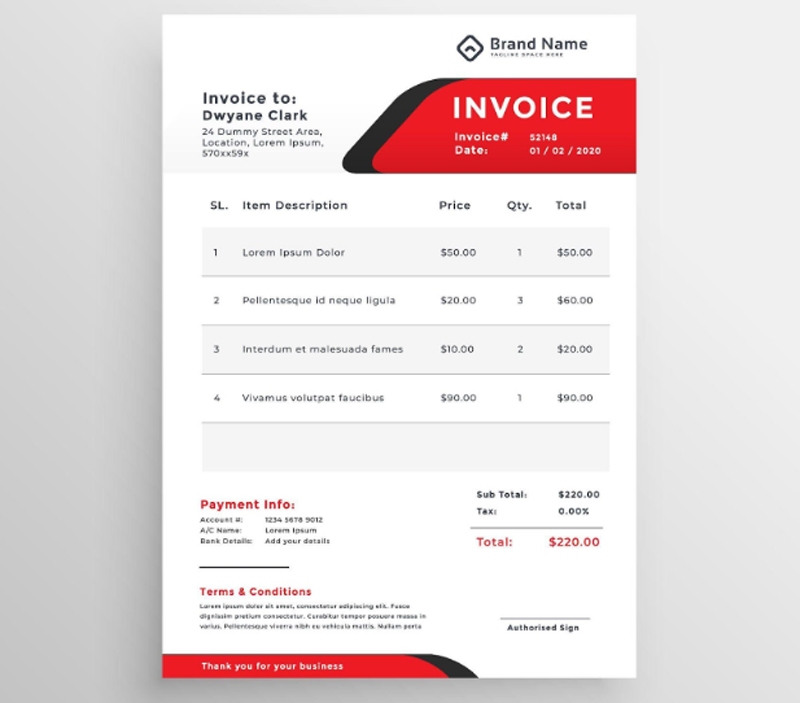

3. Formatting Style:

The formatting style is another consideration when selecting an invoice template. Some templates are designed specifically for electronic distribution, while others are printer-friendly.

When creating an invoice, businesses should keep the following tips in mind:

1. Create a Budget:

By estimating all costs upfront, you can avoid surprises or discrepancies. This will help to ensure that invoices adhere to budgeted parameters and remain accurate and legible.

2. Ensure Timescale is Adhered To:

When issuing invoices, the timeframe is vital. Templates that are flexible enough to cater to short-term and long-term requirements can be advantageous.

3. Formatting Style is Considered:

When formatting an invoice, consider the specific needs of your printing and electronic distribution channels. Some templates are designed specifically for one or both distribution methods.

Also Read: How Important Is ISO Certification For A Business in Dubai

Challenges Small Businesses Face When It Comes to Invoicing

Finances and bookkeeping can be quite a challenge for businesses of any size, but small businesses face particularly unique challenges regarding invoicing. Below are three key areas that often require special attention:

1. Tracking Expenses:

To accurately track expenses, small business owners must be able to keep meticulous records. This may include tracking amounts paid and received and specific dates and times associated with transactions.

2. Payroll Processing:

Often, payroll processing involves verifying income and controlling spending, which can add extra complications when invoicing clients or issuing payments.

3. Tracking Orders:

To ensure that orders are processed and delivered on time, small business owners must be able to keep track of customer information as well as timelines associated with each step in the process.

By following these tips, businesses can create accurate and legible invoices, adhere to budget parameters, and format them appropriately for printing and electronic distribution channels.

Also Read: Things to Consider While Choosing an Online Business Directory

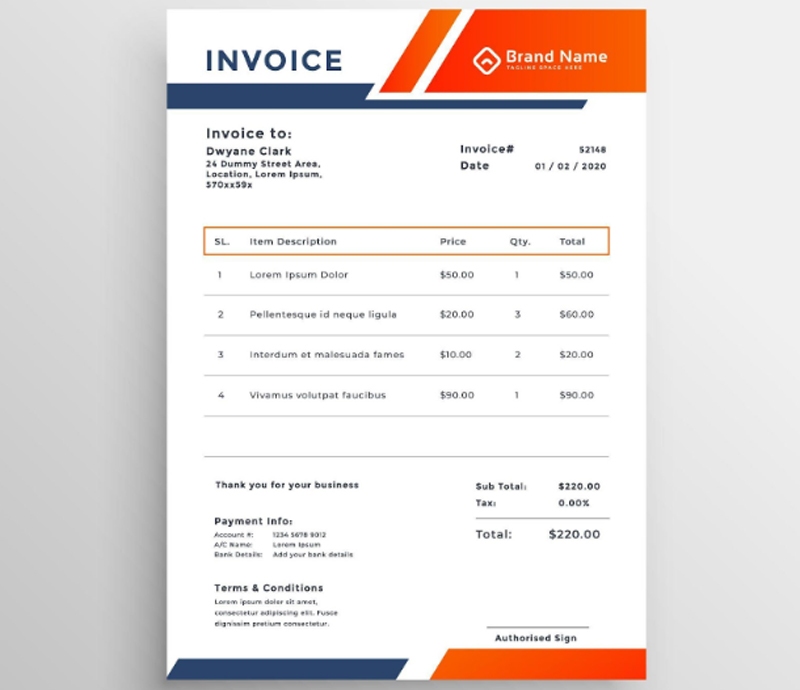

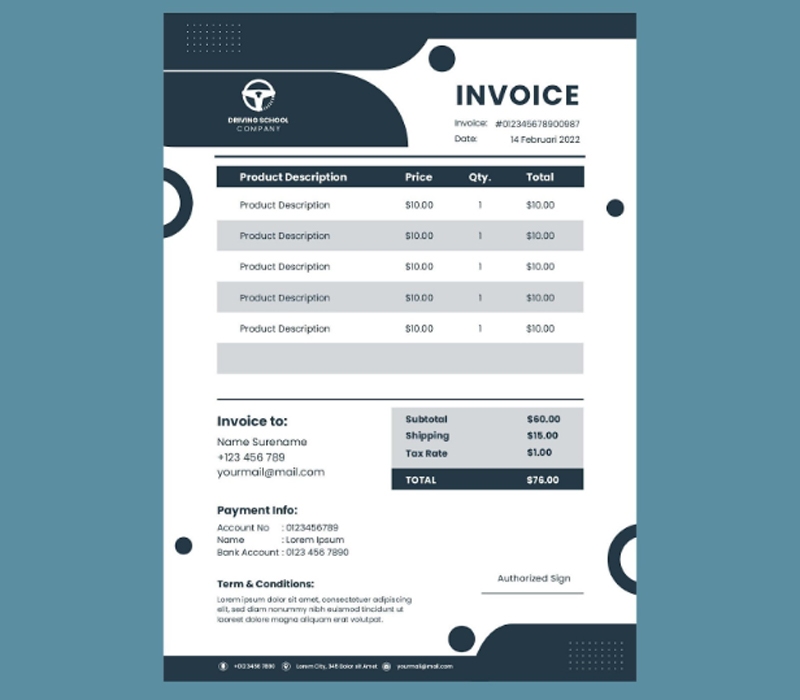

Customizing Your Invoice Template

Small businesses can customize their invoice template to fit their needs by modifying some aspects to make them more relevant to their business and customers. Some of the elements that can be customized include:

Branding: Businesses can choose to have their branding prominently featured on the invoice template, which can help recipients recognize and trust the information provided. Additionally, customizing the design of the invoice can help recipients identify your business more quickly and easily.

Information fields: By modifying the information fields on the template, businesses can ensure that all required data is included and formatted in a way that is easy to read. This can help recipients make informed decisions about your product or service and reduce time researching potential suppliers.

Payment terms: By including terms related to payment in the template, businesses can ensure that they receive payments promptly. This can reduce administrative costs and help improve overall working capital.

Language and formatting: Businesses can use specific language and design when creating their invoices, which can help recipients better understand the information being presented. Standard formats for invoice printing and electronic distribution can make it easier for recipients to find and use your invoices.

Add-ons: Small businesses can add specific software or services to their invoice template. This is a great way to reduce the time required to complete invoices, and it can help recipients better understand the value of your products or services.

By following these tips, businesses can create invoice templates that are accurate and legible, adhere to budget parameters, and format them appropriately for printing and electronic distribution channels.

Also Checkout: Top 4 Tips to Avoid Business Partnership Disputes

Best Practices for Using Invoice Templates

The use of invoice templates can help businesses reduce the time required to complete and send invoices, as well as improve their customer relationships. Best practices should be followed when creating or using an invoice template, including providing specific instructions for formatting and printing, adhering to budget parameters, and tailoring the template to suit particular business needs.

When creating an invoice template, businesses should ensure that the language and formatting are specific to the recipient. For example, electronic invoices should be formatted in a standardized way so recipients can easily find and use them. Similarly, standard print formats – such as A4 or letter size – are typically more legible than customized templates.

Invoice templates can also include add-ons or modifications to improve the efficiency and clarity of information conveyed. For example, small businesses may want to include software or services on their invoice templates in order for recipients to better understand the value of what is being offered.